- PHOENIX METRO (623) 939-3329

- TUCSON (520) 200-2958

- PRESCOTT (928) 445-3828

- PHOENIX METRO (623) 939-3329

- TUCSON (520) 200-2958

- PRESCOTT (928) 445-3828

On August 16, 2022 the U.S. government signed into law the Inflation Reduction Act (IRA) in an effort to reduce greenhouse gas (GHG) emissions by 40% by 2030. The IRA has improved the savings available from the 25C tax credit, which is also known as the Energy Efficient Home Improvement Credit. From January 1, 2023, through December 2032, homeowners can earn increased tax credits for efficiency improvements to their HVAC systems and homes.

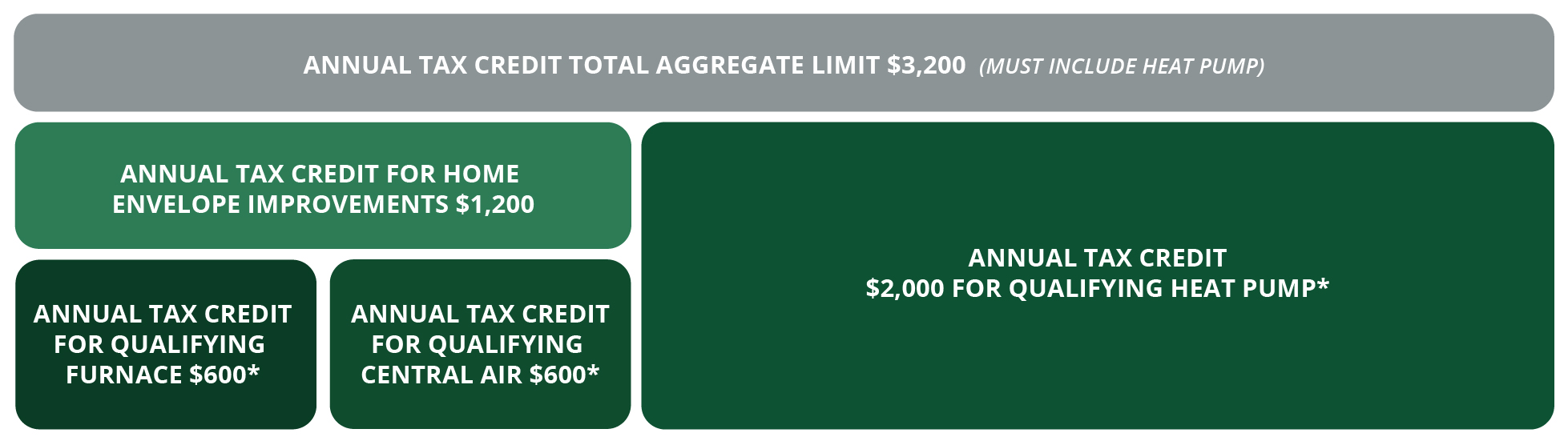

Homeowners can receive a significant federal tax credit for installing high-efficiency heating and/or air conditioning systems and building envelope improvements. Installing heat pumps comes with the most considerable financial incentives by far. Envelope improvements, like insulation and air sealing are also eligible for substantial tax credits.

Live in the Prescott or Glendale, Arizona areas? Our HVAC tax credit experts can answer your questions.

Contact Us Today!

Qualified heat pumps and ductless mini-split heat pumps (30% of project cost or maximum tax credit of $2,000)

Qualified high-efficiency furnaces or central air conditioners (30% of project cost or maximum tax credit of $600). This tax credit can total $1,200 for both a qualifying AC and furnace.

Insulation and air sealing (30% of project cost or maximum tax credit of $1,200)

A qualifying heat pump installation that meets the minimum efficiency standards that costs $10,900 would earn the homeowner the maximum tax credit of $2,000 which is 30% of the project cost. This tax credit caps at $2,000.

Contact Us

In another example, a small qualifying ductless mini split heat pump that cost $5,900 would earn the homeowner a tax credit of $1,770 which is 30% of the cost of the project. The ticket price for the mini split system is not large enough to be eligible for the $2.000 tax credit.

Contact Us

An attic insulation retrofit improvement that cost $1,800 would earn the homeowner a tax credit of $540 which is 30% of the job cost. The insulation job would have to be $4,000 or more to earn the full tax credit of $1,200.

Contact Us

The federal tax credit rewards the installation of qualifying heat pumps. Without a qualifying heat pump the maximum tax credit for the year will be $1,200. If your efficiency improvements include envelope improvement and a qualifying heat pump, the maximum tax credit per year is $3,200.

A qualifying high efficiency air conditioner and gas furnace can earn a homeowner a total tax credit of $1,200. Unlike a qualifying heat pump, a homeowner will not be able to add envelope improvements like insulation and air sealing because the cap is $1,200.

Here is a simple example on how to achieve the maximum tax credit in one year using a combination of a qualified heat pump and a major insulation upgrade. Install a qualifying heat pump that costs $10,900 would earn a homeowner a tax credit of $2,000. Purchase $4,000 worth of insulation and air sealing work would earn the $1,200 envelope improvement (30% of $4,000 is $1,200).

If a homeowner wanted to include envelope efficiency improvements like windows, doors, skylights, … that are also eligible for tax credits, it would be in their interest to stagger the improvements over multiple years.

Contact UsIt is important to know the tax credit program requirements. It can be a little confusing because there are three different types of tax credit limits: annual limit, equipment limit, and aggregate limit.

The tax credit cap each year for all eligible improvements is $1,200, unless are qualifying heat pump is included. There are a variety of home envelope improvements like insulation, air sealing, energy audits, windows/doors/skylights, and HVAC efficiency upgrades that are eligible tax credits, but the annual cap is $1,200.

There are also tax credit limits for certain types of HVAC equipment. For example, qualifying air source heat pumps has a tax credit of 30% of the project cost with a maximum of $2,000. A high efficiency gas furnace and central air conditioner each have a tax credit 30% of project cost or maximum tax credit of $600. The cap for a qualifying air conditioning system and furnace is $1,200 each year.

The third type of limit is an aggregate limit. The overall total limit on any combination of efficiency improvements is a maximum tax credit in one year is $3,200. To achieve this maximum tax credit the job must include a qualifying heat pump.

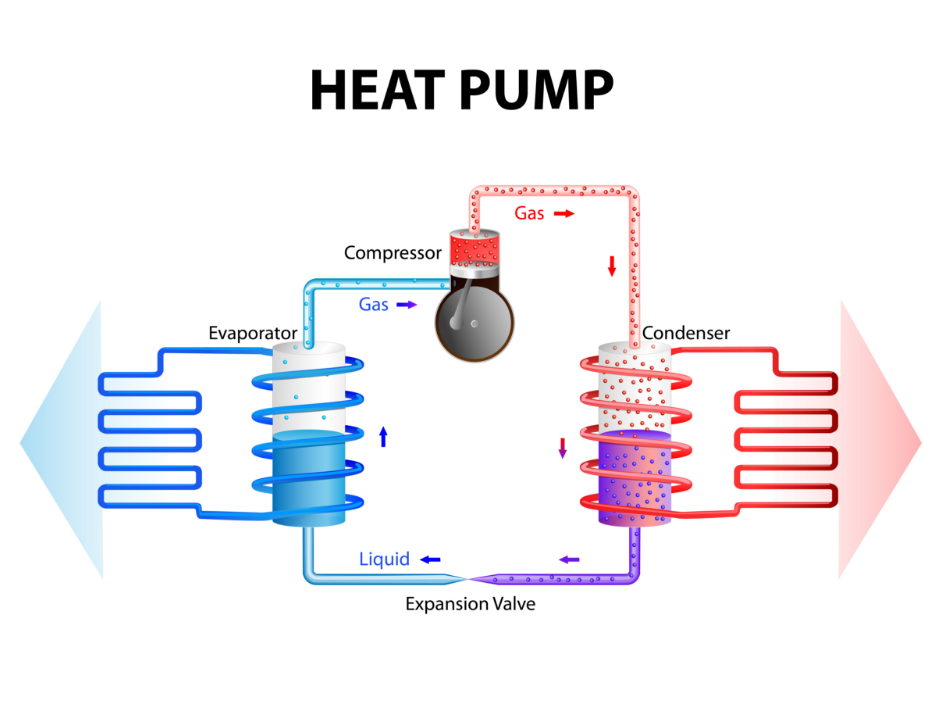

The tax credit rewards the installation of a qualifying heat pump. An electric heat pump is an all-in one heating and cooling unit, essentially an air-conditioner that runs in two directions. Heat pumps operate by using the ambient air temperature outside and either absorbing or releasing heat to the indoors. It is important to note that not all mini splits are heat pumps. Some mini splits are cool only. In other words, they do not provide heating. To be eligible for a tax credit a mini split must be a heat pump capable of both heating and cooling.

By using cleaner energy sources (typically electricity), heat pumps are more sustainable than other HVAC systems. Furthermore, the latest models can perform effectively in cold climates. Read The New York Times article on heat pump performance in cold climates.

Read This Article

Heat pumps, air conditioning systems, and gas furnaces must be high efficiency to qualify for tax credits. All manufactures should provide a list of equipment that meets the efficiency standards for tax credits.

In general, all ducted heat pumps that have earned the Energy Star label are eligible. Air source heat pumps must be certified SEER2 ≥16, EER2 ≥ 12 ≥ and HSPF2 ≥ 9. Most mini split heat pump systems easily satisfy these requirements.

Central air conditioning systems must be SEER2 > 16 to be eligible. All Energy Star certified packaged heat pump systems are also eligible.

Gas furnaces are required to meet a very high efficiency standard to be eligible for a tax credit. Energy Star certified gas furnaces must have an AFUE of ≥ 97%. It is important to keep in mind that a gas furnace that meets this requirement is significantly more expensive than a traditional gas furnace.

Tax credits are administered by the Internal Revenue Service (IRS). The tax credits are only available to a homeowner’s principal residence. Taxpayers will need a manufacturer’s certification statement from the manufacturer certifying that the product or component qualifies for the tax credit. Your contractor or the manufacturer’s website should provide this documentation. Taxpayers must keep a copy of the certification statement for their records, but do not have to submit a copy with their tax return.

You will have to claim the credit using the form below and submitting it with your tax returns to the IRS. Form 5695 Instructions can be found at this link.

Advantage Home Performance encourages homeowners to double check with your tax professional before you make a significant purchase or submit any tax forms.

Contact our HVAC and Insulation estimating team today to learn more about how tax credits can best be used to improve your home’s comfort and efficiency.

You can also visit the following government websites to gather more in-depth information about all of the tax credits for envelope and equipment improvements.